The New IOU

by Ian M. Hampson | published Mar. 4th, 2016

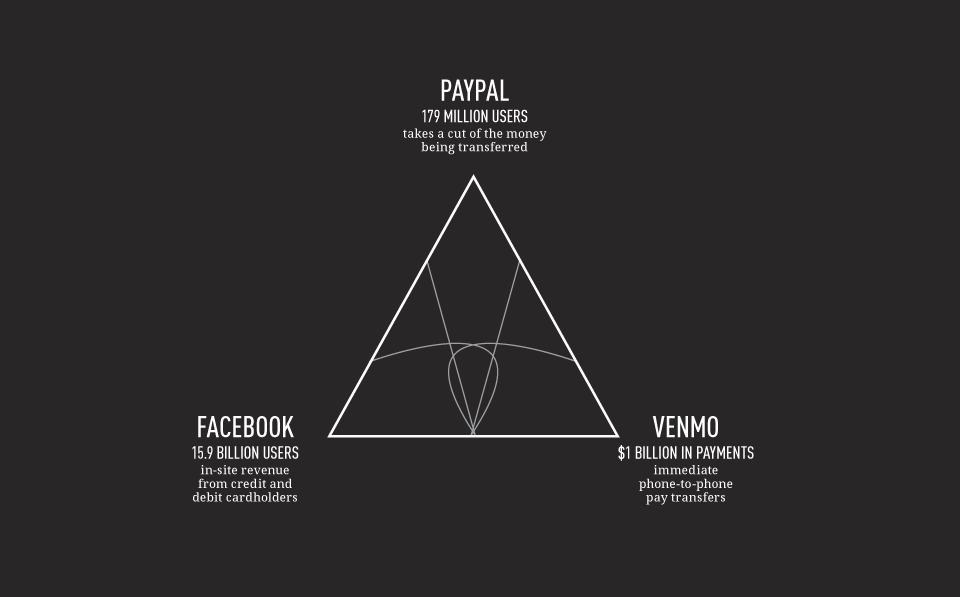

Owing someone money happens to almost every college student at one point or another, whether it's for the pizza they split last night or the drinks purchased for them by a friend. In the past, we had to repay our IOUs in the form of cash or a check, but digital payment services like Paypal, Venmo, Square Cash, Apple Pay, Facebook and even Snapchat strive to simplify that exchange and offer more convenient ways to make sure everyone is paid what they are due as soon as possible.

Now, Paypal is likely a name that everyone is familiar with. It is a money transferring website that also allows people to pay online through a single, secure profile with the included convenience of freeing people from inputting their card information for every purchase they wish to make. Paypal also aims to assist the digital entrepreneur by offering payment handling services to small businesses ranging from online payment all the way to including in-store payment options like a mobile card reader or other point of sale solutions.

Venmo is a more mobile and feature-focused service currently owned by Paypal that strives to bring peer-to-peer transfers to the palm of people's hands. It is hailed as the premier mobile app for convenience and speed. It allows many of the same payment methods as Paypal, debit/credit cards and many bank accounts and brings that access to iOS and Android phones to enable users to transfer funds as soon as the need arises.

Even Facebook has begun reaching into the peer-to-peer market when refining their standalone Messenger app to include Facebook Payments. It allows for simple transfers from one debit account to another for either Visa or Mastercard cardholders, thus trying to keep users on one site where most of Facebook’s revenue is generated.

An informal poll of 10 students at RIT showed that they all knew about Paypal regardless of whether they used it frequently or not, but many people had either forgotten or never heard about Facebook Payments as an option. Also, most people who used Venmo used it frequently and had been doing so for longer than six months. Venmo has been recognized by Paypal as a gateway for millennials to access Paypal services and generate revenue for the company at the same rate as the full feature Paypal site. That line of thinking was reflected among the RIT students polled, since most of them had Venmo installed on their phones either for frequent access or just a convenient option to pay a friend back for gas or meals. Paypal seems to be commonly used for more business transactions than either Facebook or Venmo and most people polled had a Paypal account along with using either of the other services. Paypal seems to hold the broadest reach in the student population because of its digital integration across the web.

All of these services come with their pros and cons. Many students wonder whether they come with hefty security risks, especially those who do not necessarily know the ins and outs of digital security. According to Chaim Sanders, a lecturer from the Department of Computing Security, security isn't generally an issue.

“It’s much easier for students and faculty, literally everyone in the world, to just pick their favorite,” he said. He then clarified that people should choose “known services,” as those services generally hold sufficient encryption and normally would require a nation or state level of computing power to crack.

One of the largest factors in the comparison of security levels is from where a service is generally accessed. Venmo is a largely mobile service where phone-to-phone transfers are actually the norm. This can easily lead to serious concerns if your phone is lost and your Venmo or Facebook account is signed in. That is why phone producers always suggest passcodes or other locks in order to help avoid these issues. In general there are some key things that users should be looking for if they decide to try out a new vendor. One of the largest is two-factor authentication, which is an option or even required for most of the larger banks and services that store your banking information.

Two-factor authentication covers two of the three factors of “something you know, something you have or something you are,” that Sanders says most security professionals aim to include. These factors can range from knowing a password and having a separate email, to having a thumb print scanner on your phone and knowing the password to your account.

Most apps will not require two step authentication, but will likely have an option for it in their security or privacy settings.

“The be-all end-all advice right now would be to go with well established vendors. Don’t go with someone that you’ve never heard of, be extremely cautious of who you’re entering personalized information about your bank account and your lives to in terms of money, especially,” Sanders emphasized. This will ensure that people do not fall into bad situations where they lose control of sensitive information.

These questions of technological security will likely continue to grow as more and more pieces of our life are connected in the digital age, but it seems that when people exercise good internet security practices, they rest assured knowing that sending money for groceries or nights out through Paypal, Venmo and Facebook Payments will not expose them, or their bank account, to any additional risk.